W2 payroll tax calculator

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Therefore if you have a traditional W2 job then you should see taxes being withheld.

W2 Tax Document Business Template Tax Bill Template

Easy-To-Use Online Invoice Software.

. The maximum an employee will pay in 2022 is 911400. Total annual income Tax liability. Free Unbiased Reviews Top Picks.

The information you give your employer on Form W4. As the employer you must also match your employees contributions. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

All Services Backed by Tax Guarantee. How It Works. Free Unbiased Reviews Top Picks.

See how your refund take-home pay or tax due are affected by withholding amount. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. Estimate your federal income tax withholding.

What does eSmart Paychecks FREE Payroll Calculator do. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Ad Compare This Years Top 5 Free Payroll Software.

If you work for. Payroll taxes are automatically assessed by all W2 employers in the United States. Under FICA you also need to withhold 145 See more.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Get an accurate picture of the employees gross pay. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

2 File Online Print - 100 Free. SurePayrolls free payroll tax calculator helps small business owners easily calculate payroll taxes for DIY payroll. Ad 1 Use Our W-2 Calculator To Fill Out Form.

Get Your Quote Today with SurePayroll. It will confirm the deductions you include on your. Online Support for All Business Sizes.

For help with your withholding you may use the Tax Withholding Estimator. Free Unbiased Reviews Top Picks. Ad 1 Use Our W-2 Calculator To Fill Out Form.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. 2 File Online Print - 100 Free.

The standard FUTA tax rate is 6 so your max. Ad Compare This Years 10 Best Payroll Services Systems. You can use the Tax Withholding.

Use this calculator to view the numbers side by side and compare your take home income. Use this tool to. Calculate your Total W-2 Earnings After all those steps above you may subtract the total taxes from your gross income from the number you got from your pretax deductions and your other.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. The calculator includes options for estimating Federal Social Security and Medicare Tax. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Skip To The Main Content. Gross Pay Calculator Plug in the amount of money youd like to take home. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Get Started Today with 2 Months Free. Ad Compare This Years Top 5 Free Payroll Software. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your.

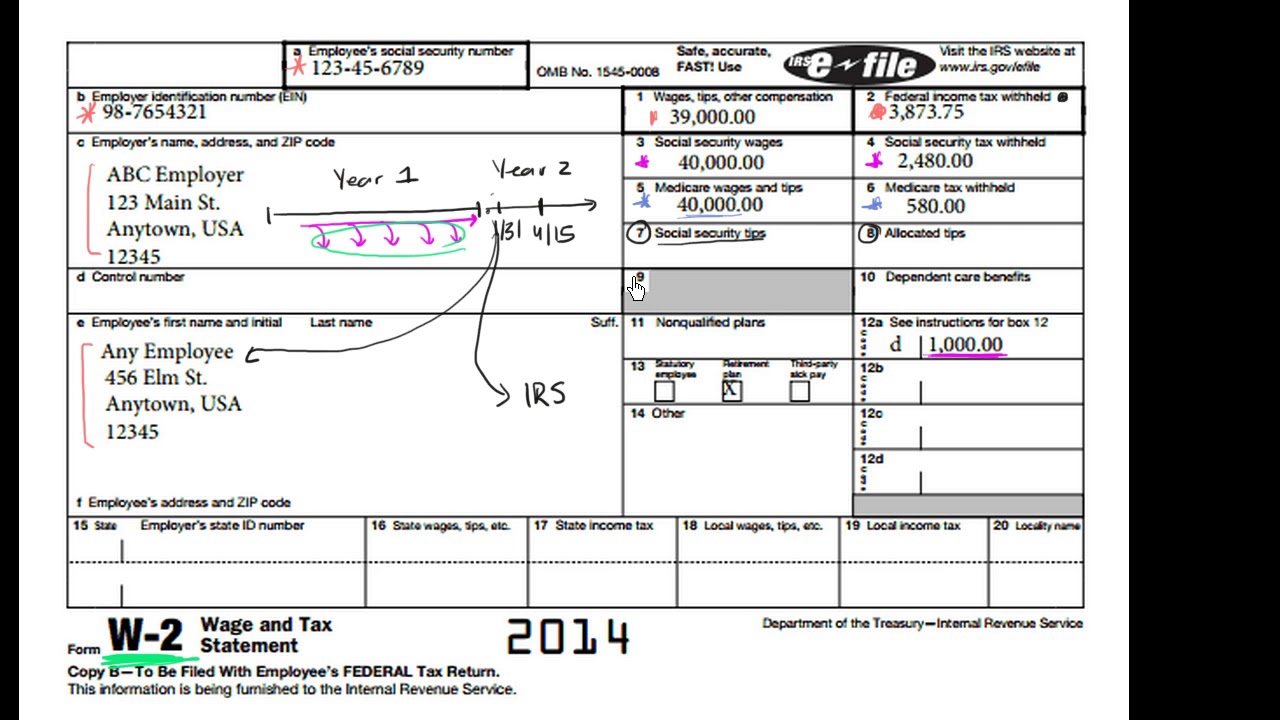

Intro To The W 2 Video Tax Forms Khan Academy

How To Fill Out A W 2 Tax Form For Employees Smartasset

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

Solved W2 Box 1 Not Calculating Correctly

You Need An Expert To Help You Get That Form 941 Amended To Get Loads Of Cash Back That Belongs To You In 2022 Payroll Taxes Business Marketing Strategy

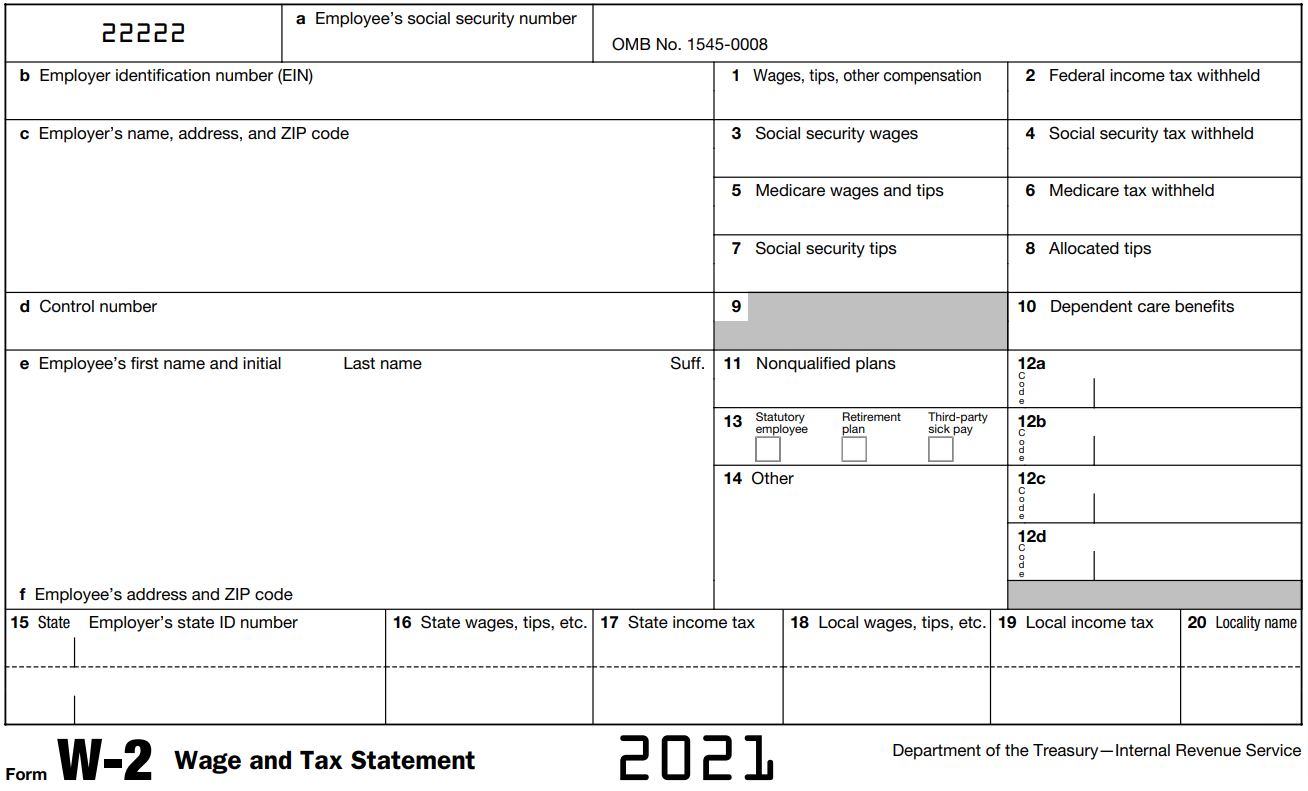

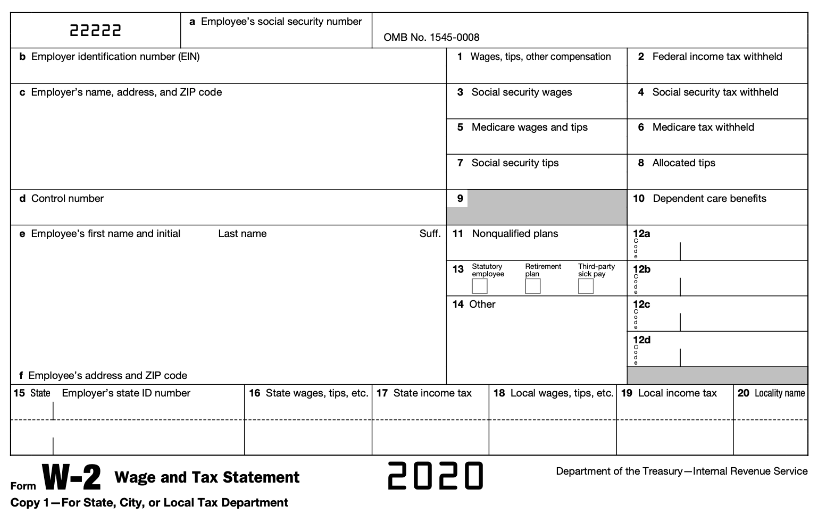

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

How To Read A Form W 2

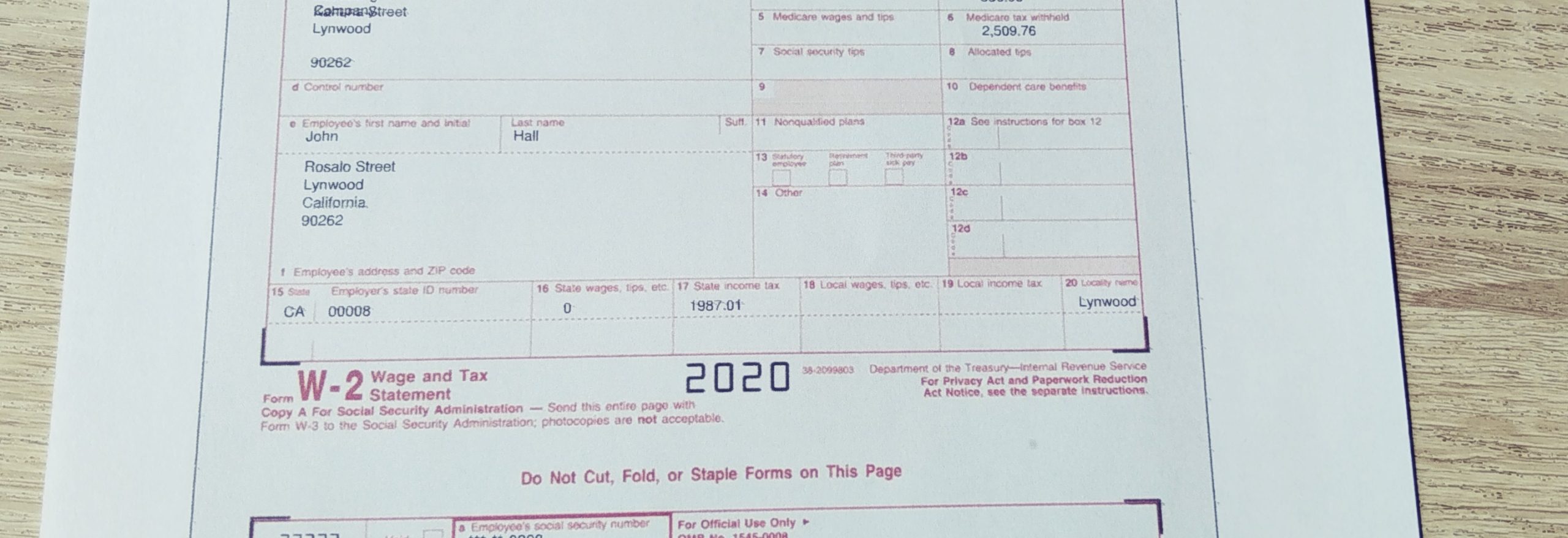

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Pin On Starting A Business Side Hustles After Divorce

Understanding Your W 2 Controller S Office

How To Calculate W2 Wages From Paystub Paystub Direct

How To Determine Your Total Income Tax Withholding Tax Rates Org

W12 Tax Form Example Is W12 Tax Form Example Still Relevant Tax Forms W2 Forms Filing Taxes

W2 Online No 1 W2 Generator Thepaystubs